The value of a decedent's gross probate estate, less liens and encumbrances, does not exceed $50,000.

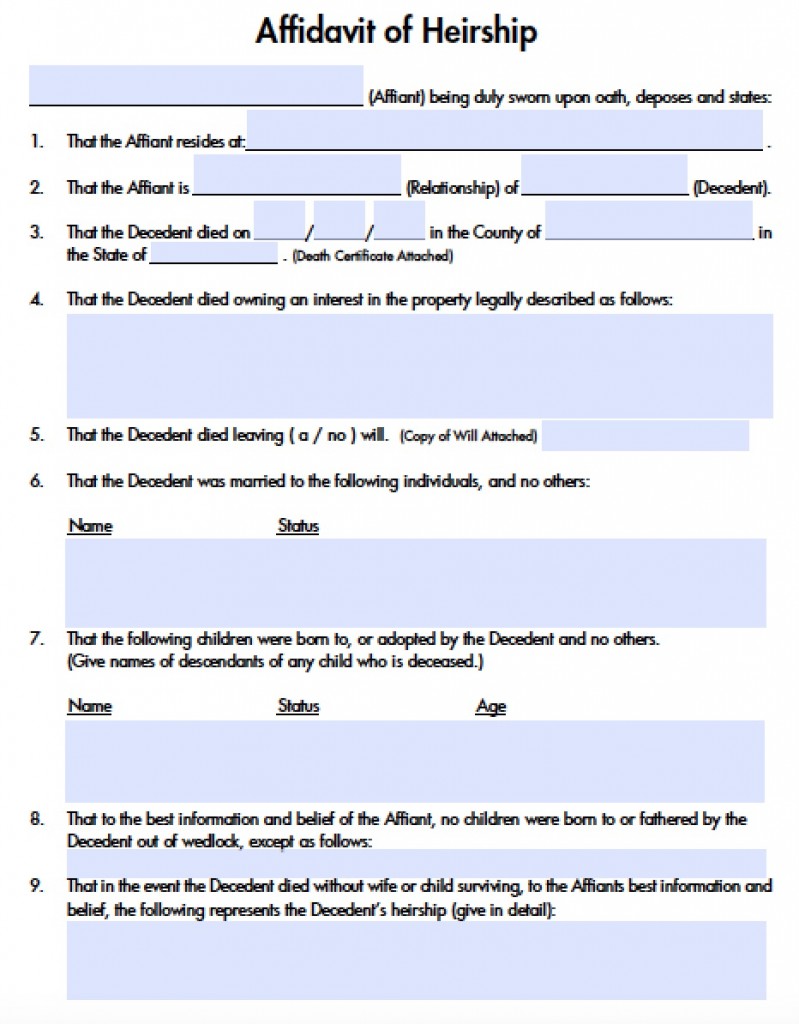

The gross value of the Decedent's entire estate wherever located and including any contents of a safe deposit box, excluding liens and encumbrances, is, which does not exceed the state limit of $50,000. The Decedent's estate does not include real property. The current gross fair market value of the decedent's real and personal property in California, excluding the property described in Section 13050 of the California Probate Code, does not exceed one hundred sixty six thousand two hundred and fifty dollars ($166,250). The gross value of the Decedent's entire estate including real property, wherever located, excluding liens and encumbrances, does not exceed. The gross value of the Decedent's entire estate including real property, wherever located and including contents of a safe deposit box but excluding liens and encumbrances, does not exceed. The Total value of the decedent's property subject to administration in Wisconsin at the date of death did not exceed $50,000. No proceeding is now being or has been conducted in California for administration of the decedent's estate. No letters of office are now outstanding on the Decedent's estate, and no petition for the appointment of a personal representative has been granted or is pending in or in any other State to my knowledge. The affiant or declarant is the successor of the decedent (as defined in Section 13006 of the California Probate Code) to the decedent's interest in the described property.ģ0 40 45, as shown in a certified copy of the decedent's death certificate attached to this affidavit or declaration I am a successor of the Decedent's estate and am at or over the age of majority and am legally competent in all respects to make this affidavit.

0 kommentar(er)

0 kommentar(er)